Effortless Transaction Integration

Our platform automates the integration of client transactions with accounting software, streamlining your workflow for greater accuracy and efficiency.

From Transaction Capture to Accurate Reconciliation—Automated Every Step of the Way

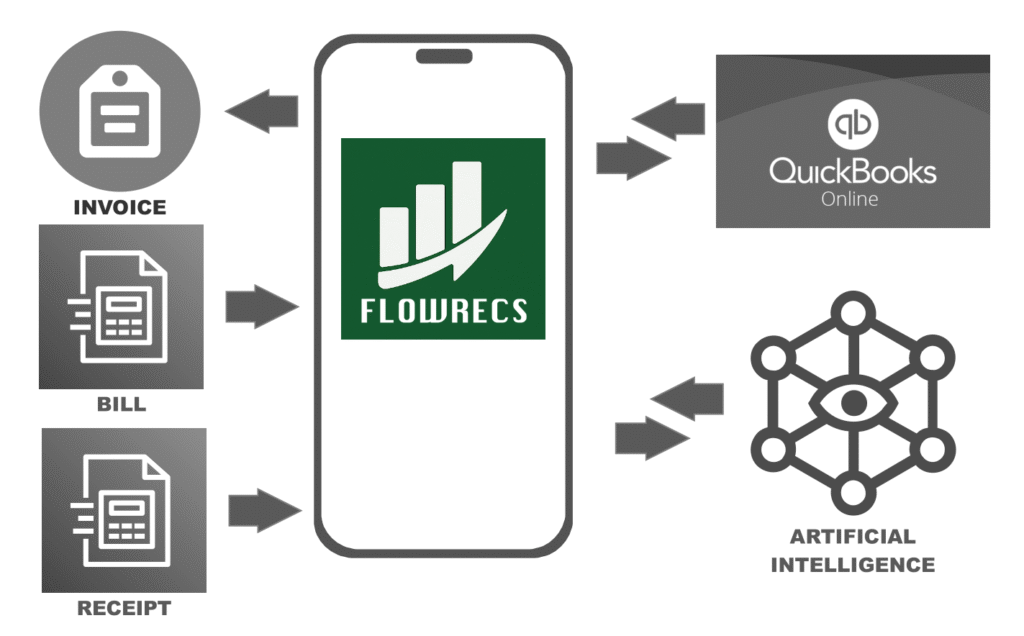

Seamless Automation Workflow

Our platform transforms transaction processing for accounting professionals. Flowrecs reads bills and receipts. It understands what the cost represents in relation to the client’s business; categorizes the cost, and enters a transaction into QBO with the bill or receipt as an attachment.

Flowrecs also reviews past credit card and bank statements regularly so that it uses familiar terminology to make statement reconciliation easier.

Never miss a client transaction again.

Automated AI Transaction Capture

Scan a bill or receipt and Flowrecs will extract and interpret the data wtih reference to your accounting categories and vendors.

Stay current, always accurate.

Real-Time Sync to Accounting Software

Keep your books up-to-date with instant syncing between client bills and transactions and your accounting platform.

Reconcile faster with automation.

Improved Reconciliation

The system reviews and updates naming convention from banks and credit cards so that names on scanned invoices match.

Why Automate Transaction Sync?

Automated transaction syncing eliminates manual data entry, reducing the risk of errors and ensuring financial records are always accurate.

Bookkeepers and accountants save valuable time, allowing them to focus on advisory work rather than repetitive tasks. This leads to faster close cycles and real-time insights for clients.

By integrating seamlessly with your existing accounting software, our platform streamlines workflows and boosts overall business efficiency. Experience reliable, up-to-date data and improved collaboration across your accounting team.

Start Automating Your Workflow

Ready to streamline your bookkeeping process? Integrate client transactions with your accounting software and experience improved accuracy and time savings. Take the next step to smarter accounting today.